Product & Supplier Management Services

Some of the many services we offer - see our full list of services here

Product Sourcing

We can take care of all product & supplier sourcing.

Manufacture Sourcing

Sourcing your manufacturing & fabrication needs.

Price Negotiations

We ensure you pay the best price for your product.

Factory Visits

We regularly visit factories to check procedures, standards and quality.

International Freight & Shipping

Arranging internal Chinese transport, international shipping and transport within Australia.

Branded Package & Labeling

Add that extra touch of quality! We can arrange packaging and branding of your products.

Lower your risk, increase your profit.

With over ten years in the industry, Vara Allied has the experience and contacts you need to minimise your risk and negotiate the best trading terms to get you the right product at the best price.

We understand Australian quality expectations and how to do business in Asia so you can benefit from reduced costs and increased profits without the added hassle and headache of doing the running around yourself.

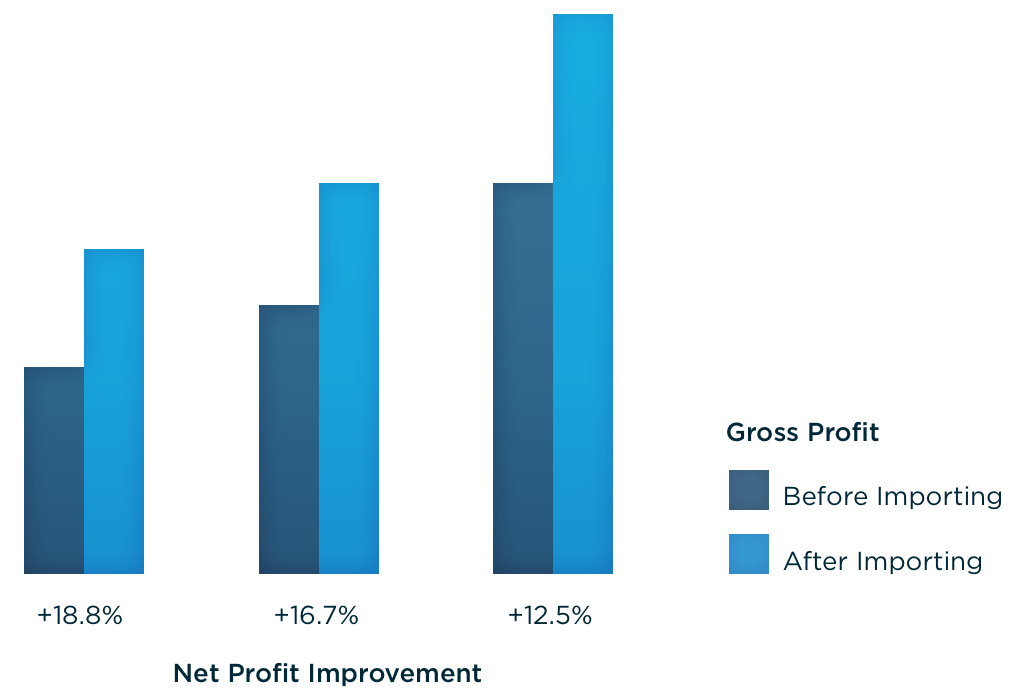

Examples of Improved profitibility from Importing

| 25% GP | 33.3% GP | 50% GP | |

|---|---|---|---|

| Initial Buy / Mark-up | 50.00 / 33.3% | 50.00 / 50.0% | 50.00 / 100.0% |

| GP Before Importing | 25.0% | 33.3% | 50.0% |

| New Buy / Mark-up | 37.50 / 77.8% | 37.50 / 100.0% | 37.50 / 166.7% |

| GP After Importing | 43.7% | 50.0% | 62.5% |

| Sell Price | 66.67 | 75.00 | 100.00 |

| Net Profit Improvement | 18.8% | 16.7% | 12.5% |